First off, Apple’s new iPhone, the 4S. Some are miffed that it’s not “iPhone 5.” Some are miffed that it is, essentially, only a minor improvement over the iPhone 4. Some are wondering why they would replace their current iPhone 4 with one of these. To all of these people I say… je ne give a shit pas, I’m getting me an iPhone. I’ve been waiting to get an iPhone for more than 3 years now (long story… no, a short story: got locked into a contract. Bleh) and I *need* a new phone.

(Some may say “want” but I say “need.” Because I need it. I do. Me. Need. Need a new phone. Now. Yes. Need. But I digress…)

Oh, and to those who already have an iPhone 4; you probably have a contract, so the fact that this phone is only an incremental upgrade is probably a good thing for you. Yay! Think how much more pissed off you’d be if this was THE GREATEST PHONE ON EARTH… and you couldn’t get one because you were locked into a contract. Meh. (How’s that for ‘silver lining’ thinking?) Of course, if you’re not locked into a contract and you’re wondering if you should dump your iPhone 4 for an iPhone 4S… I’d probably say ‘no,’ but it’s up to you, dude. Don’t let me tell you what to do. And don’t listen to those dumbass pundits and so-called ‘experts,’ either. Figure it out yourself.

But the other interesting thing that happened today had to do with “AAPL,” that is to say, Apple’s stock and the price thereof.

A while back, you may recall, Apple’s Market Cap exceeded that of MicroSoft. Market Cap, or Market Capitalization, is a measure of how large a company is. Essentially, you take the company’s stock price and multiply that by the number of stocks issued, and you get the company’s Market Cap value (measured in good old dollars). Bigger is better. It is ‘a’ measure of the size of a company, but by no means the only one.

When Apple surpassed MicroSoft on this scale, it was a pretty Big Deal(TM). And, at that time, the only company with a bigger Market Cap was Exxon Mobil (Ticker: XOM). And slowly but surely, Apple started to close that gap.

Market Cap is one of those things that you hear a lot about in the news, probably because it is so volatile. Market Caps go up and down every day, while we have to wait a whole boring three months to get a company’s quarterly financial reports. So Market Cap swings make for great news.

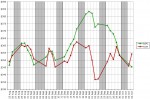

Well, as Apple started closing that gap, I started keeping track of the numbers. And like any good engineer would, I graphed them. Thus, I present:

(Click to Embiggen in a new Window)

(Click to Embiggen in a new Window)

This is a graph comparing the Market Caps of AAPL and XOM, from the 25th of August 2011 until today. The numbers on the vertical axis are in Billions of Dollars. As you can see, AAPL briefly exceeded XOM on the 26th, and they danced around for a couple of days… and then, on the 8th of September, AAPL pulled ahead… and stayed ahead. At one point (23 September), AAPL was ahead by $37.8 Billion. At that point, Apple Inc was, essentially, *the* largest company in the US (by Market Cap), and probably one of the top three or so largest companies in the world.

Their peak was on 20 September, where, by Market Cap, Apple (the company) was worth $383 Billion dollars. That is to say, that’s what it would cost you to buy each and every stock of AAPL out there. Unlike *some* companies I could name (*cough*dell*cough*rim*cough*hp*cough*), whose Market Cap is well within the ability of Apple to buy… out of petty cash. But I digress…

AAPL stayed ahead (albeit only by a paltry $380 Million on 30 September) until today. And, as usual for Apple, during today’s announcement of a new product (what for most companies is good news) their stock took a pummelling, while XOM surged and over took, giving Exxon a Market Cap lead of $8.7 Billion.

As I said, this is typical for Apple. Their stock always seems to go down when they have good news to announce. Ah well, c’est la vie, as they say. But it will be interesting to watch the stocks and see how the Market Cap numbers go over the next few months. Some have predicted that, not only will AAPL exceed XOM in Market Cap value, but AAPL may be the first stock to reach a Market Cap of $1 Trillion. (OK, admit it; you read that in Dr. Evil’s voice, didn’t you? I know I typed it in his voice, so it’s understandable if you did.)

The other interesting thing you get from these numbers, when compared to the actual stock prices of the two companies: Apple has a whopping 927 Million shares on the market, while Exxon has issued a mind boggling 4.8 *Billion* shares. So if you own a few shares (of either company)… it’s probably pretty insignificant. You’re welcome.

And now that September has ended (someone wake up that Green Day guy), we look forward to another of those quarterly financial results announcements. This next one will be for the fourth quarter of 2011, so we’ll be able to aggregate the numbers for the annual results also. And I am going out on a limb and predicting that Apple’s gross annual revenue will exceed $100 Billion this year. Obviously, sales of this latest iPhone will not have an effect on 2011 annual figures, as the next three months are the first quarter of fiscal year 2012. But recall that iPhone 4 was a very successful product, one of the most popular selling phones of the time. Not to mention income from iPad 2. Oh, yeah; and they also sell computers. Heh.

But let’s think about that for a moment. Last year, there were only 17 companies on the Fortune 500 whose gross annual revenue was more than $100 Billion. The biggest of those was Wal Mart, with $421 Billion. That’s no surprise; they’ve been #1 all but three times in the last 10 years, and those times, they were a close #2.

So the “$100 Billion a year club” a pretty exclusive group of companies. And I am predicting that Apple will join them for 2011. As a matter of fact, I’ll double down on that bet, and predict total annual revenue somewhere between $113 and $116 Billion, which should place them somewhere around 15th or 16th on the Fortune 500 list. So stay tuned, kids! We’ll have to wait for Apple’s quarterly results, and for the good folks at Fortune Magazine to produce the 2011 list, but I’m betting it will be worth the wait.

Cheers!